How is Real Estate Investing in Atlanta GA?

Real estate investing in Atlanta, GA can be a lucrative and rewarding venture for those who are willing to put in the time and effort. Here are some key factors to consider when investing in Atlanta real estate:

Market Demand: Atlanta is one of the fastest-growing cities in the United States, with a strong demand for housing and commercial properties. The city’s population has grown by over 20% in the last decade, and this trend is expected to continue. Additionally, Atlanta is a major economic hub, with a diverse range of industries and a growing startup scene, which can create opportunities for commercial real estate investment.

Neighborhoods: Atlanta is a diverse city with many different neighborhoods, each with its own character, culture, and real estate market. Some of the most popular neighborhoods for real estate investment include Midtown, Buckhead, Virginia Highland, and Inman Park. Each of these neighborhoods has its own unique features and amenities, which can attract different types of tenants and buyers.

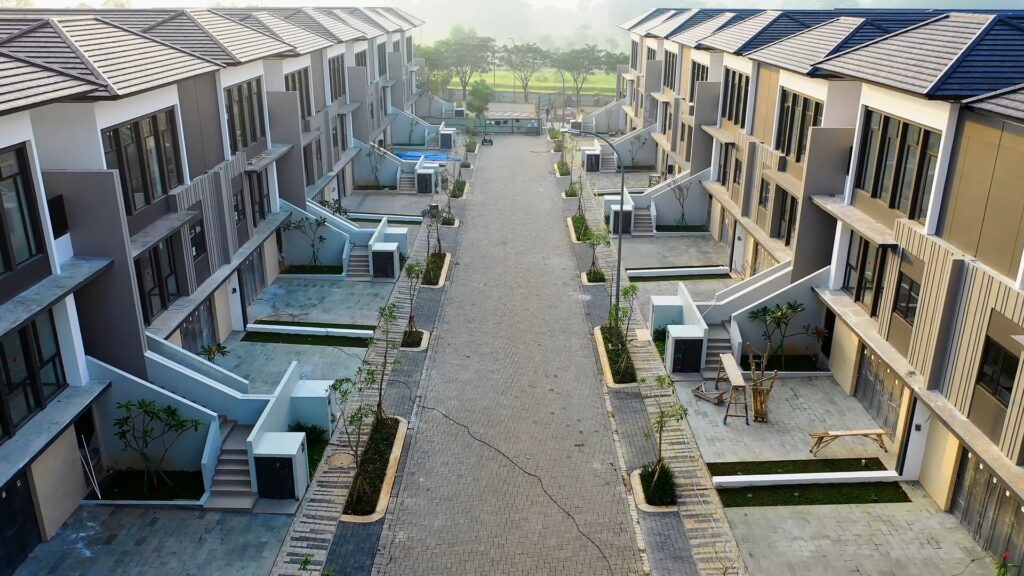

Property Types: Atlanta has a range of property types available for investment, including single-family homes, townhouses, condominiums, and commercial properties such as office buildings, retail centers, and industrial parks. Depending on your goals and expertise, you may choose to specialize in one or more of these property types.

Financing Options: There are many financing options available for real estate investors in Atlanta, including traditional bank loans, private lenders, and crowdfunding platforms. It’s important to do your research and compare rates and terms to find the best financing option for your needs.

Regulations and Taxes: Like any real estate market, Atlanta has its own set of regulations and taxes that investors need to be aware of. For example, Georgia has a state income tax rate of 5.75%, and Atlanta has a 1% sales tax on most goods and services. Additionally, landlords in Atlanta must comply with local regulations regarding tenant rights and property maintenance.

Rental Rates: Rental rates in Atlanta have been steadily increasing over the last few years, with the average rent for a one-bedroom apartment in the city currently around $1,200 per month. This can provide a steady source of income for investors who choose to purchase rental properties in high-demand areas.

Property Appreciation: The Atlanta real estate market has been appreciating steadily over the last few years, with home values in the city increasing by over 9% in 2020 alone. This means that investors who purchase properties in the right neighborhoods can benefit from long-term property appreciation, as well as potential short-term gains through resale.

Strong Economy: Atlanta is home to many major corporations and has a diverse economy, with a strong presence in industries such as finance, technology, and logistics. This can create opportunities for commercial real estate investment, as well as providing a stable economic foundation for the city’s real estate market.

Proximity to Major Transportation Hubs: Atlanta is home to one of the busiest airports in the world and is a major transportation hub for the southeastern United States. This can make it an attractive location for commercial real estate investment, as well as providing easy access to transportation for residents and businesses.

Overall, real estate investing in Atlanta, GA can be a profitable and rewarding venture for those who are willing to do their research, stay up-to-date on market trends, and make strategic investments. By choosing the right neighborhoods, property types, and financing options, and staying compliant with local regulations and taxes, investors can build a strong and successful real estate portfolio in Atlanta. With a growing population, strong economy, and diverse range of properties and industries, Atlanta is a prime location for real estate investment in the United States.

Comments are Disabled