Posts in Category: Atlanta Real Estate Market

What Is The Impact of Inflation on Real Estate Investing?

Inflation can have a significant impact on real estate investing, both in terms of the value of properties and the returns that investors can expect to earn. Here are some key ways that inflation can affect real estate investing:

Property Values: Inflation can impact property values by increasing the cost of building materials, labor, and other expenses associated with real estate development. This can lead to higher construction costs, which in turn can lead to higher property values.

Rent Prices: Inflation can also impact the price of rent, as landlords may need to increase rents in order to keep up with rising operating costs. This can be particularly challenging for tenants who are on fixed incomes or have limited housing options.

Financing Costs: Inflation can also impact financing costs, as interest rates may rise in response to inflationary pressures. This can make it more expensive for real estate investors to borrow money to finance their investments.

Cash Flow: Inflation can impact cash flow by reducing the purchasing power of rental income. For example, if rent prices do not increase as quickly as inflation, the value of rental income may decrease over time. This can make it more difficult for investors to generate positive cash flow from their real estate investments.

Asset Allocation: Inflation can also impact the allocation of assets within a real estate portfolio. For example, in a high inflation environment, investors may prefer to hold assets that are less sensitive to inflation, such as commodities or inflation-protected securities.

Despite the potential challenges posed by inflation, there are also ways that real estate investors can benefit from inflationary environments. For example, rising property values can lead to increased equity in a property, which can in turn increase the potential for capital gains when the property is sold. Additionally, rising rents can lead to increased cash flow, which can provide a source of income for investors.

To mitigate the impact of inflation on real estate investing, investors may consider taking the following steps:

Invest in properties that are likely to hold their value over time, such as properties in high-demand locations or properties that have unique features that make them desirable to tenants.

Consider investing in properties with long-term leases that include rent escalation clauses that are tied to inflation.

Consider investing in properties with fixed-rate financing in order to lock in financing costs and reduce the impact of rising interest rates.

Stay informed about macroeconomic trends and adjust investment strategies accordingly in response to changing inflationary pressures.

In conclusion, inflation can have a significant impact on real estate investing, but there are steps that investors can take to mitigate its effects. By staying informed about macroeconomic trends, carefully selecting properties, and considering different financing options, real estate investors can successfully navigate the challenges posed by inflation and earn attractive returns from their investments.

Where Is The Safest Area in Atlanta To Live?

As one of the largest cities in the United States, Atlanta has a diverse range of neighborhoods, each with its own character and safety considerations. While crime rates can vary depending on location, there are several neighborhoods in Atlanta that are generally considered to be safe places to live.

Buckhead: Buckhead is a popular neighborhood in Atlanta that is known for its luxury shopping, fine dining, and upscale residential areas. It is also considered one of the safest neighborhoods in Atlanta, with a low crime rate and a strong police presence.

Midtown: Midtown is a vibrant neighborhood in the heart of Atlanta that is home to many cultural attractions, including the High Museum of Art, the Fox Theatre, and the Atlanta Symphony Orchestra. It is also considered a safe neighborhood, with a low crime rate and a strong sense of community.

Decatur: Decatur is a historic neighborhood located just east of Atlanta that is known for its charming downtown area, excellent schools, and family-friendly atmosphere. It is also considered one of the safest neighborhoods in Atlanta, with a low crime rate and a strong sense of community.

Virginia Highland: Virginia Highland is a trendy neighborhood located just east of Midtown that is known for its eclectic mix of shops, restaurants, and bars. It is also considered a safe neighborhood, with a low crime rate and a strong sense of community.

Druid Hills: Druid Hills is a historic neighborhood located just east of Midtown that is known for its beautiful homes, tree-lined streets, and lush green spaces. It is also considered one of the safest neighborhoods in Atlanta, with a low crime rate and a strong sense of community.

Inman Park: Inman Park is a vibrant neighborhood located just east of Midtown that is known for its hip restaurants, coffee shops, and boutiques. It is also considered a safe neighborhood, with a low crime rate and a strong sense of community.

While these neighborhoods are generally considered safe places to live in Atlanta, it’s important to keep in mind that crime can occur anywhere, and it’s always a good idea to take basic safety precautions, such as locking doors and windows and being aware of your surroundings. Additionally, crime rates can vary depending on location within a neighborhood, so it’s a good idea to research crime statistics for specific areas before making a decision about where to live.

Overall, Atlanta offers a variety of safe neighborhoods to choose from, each with its own unique character and amenities. By doing your research and taking basic safety precautions, you can find a neighborhood that meets your needs and provides a safe and comfortable place to call home.

Is Moving to Atlanta a Good Idea?

Moving to Atlanta can be a great idea for many people, depending on their lifestyle, preferences, and career goals. Atlanta has a great deal to offer its residents and it is certainly an area worth considering for a move.

Here are some factors to consider when deciding whether or not to move to Atlanta:

Cost of Living: One of the most important factors to consider when moving to Atlanta is the cost of living. Overall, the cost of living in Atlanta is lower than many other major cities in the United States, such as New York, Los Angeles, or San Francisco. However, certain expenses, such as housing and transportation, can still be relatively high, especially in popular neighborhoods such as Midtown, Buckhead, or Virginia Highland.

Job Opportunities: Atlanta is a major economic hub in the southeastern United States, with a diverse range of industries, including finance, technology, healthcare, and media. Some of the top employers in Atlanta include Delta Airlines, Coca-Cola, Home Depot, and UPS. Additionally, Atlanta is home to a growing startup scene, with many incubators and accelerators supporting local entrepreneurs.

Weather: Atlanta has a humid subtropical climate, with hot summers and mild winters. While the warm weather can be a draw for many people, the humidity and occasional thunderstorms can be a downside for others.

Transportation: Atlanta is known for its traffic, and commuting can be a challenge for many residents. However, the city has made significant investments in public transportation in recent years, including expanding the MARTA subway system and adding bike lanes and pedestrian infrastructure. Additionally, many neighborhoods in Atlanta are walkable and bike-friendly, making it easy to get around without a car.

Culture and Entertainment: Atlanta has a rich cultural scene, with many museums, theaters, and music venues, as well as festivals and events throughout the year. Additionally, Atlanta is known for its vibrant food scene, with many restaurants offering Southern cuisine as well as international flavors.

Diversity: Atlanta is a diverse city, with a population that includes people from a variety of ethnic and cultural backgrounds. The city is known for its LGBTQ community, as well as its historically Black neighborhoods such as Sweet Auburn and Vine City.

Overall, moving to Atlanta can be a good idea for many people, especially those who are looking for job opportunities, a lower cost of living compared to other major cities, and a diverse and vibrant culture. There are beautiful nature parks in the surrounding area, plenty of opportunities for dining, and so much more to enjoy. Atlanta, Georgia truly has plenty to offer to those who live there. However, it’s important to consider factors such as the weather, transportation, and specific neighborhoods when making a decision about where to live. By doing your research and exploring different areas of the city, you can find the best fit for your needs and make a smooth transition to life in Atlanta.

How is Real Estate Investing in Atlanta GA?

Real estate investing in Atlanta, GA can be a lucrative and rewarding venture for those who are willing to put in the time and effort. Here are some key factors to consider when investing in Atlanta real estate:

Market Demand: Atlanta is one of the fastest-growing cities in the United States, with a strong demand for housing and commercial properties. The city’s population has grown by over 20% in the last decade, and this trend is expected to continue. Additionally, Atlanta is a major economic hub, with a diverse range of industries and a growing startup scene, which can create opportunities for commercial real estate investment.

Neighborhoods: Atlanta is a diverse city with many different neighborhoods, each with its own character, culture, and real estate market. Some of the most popular neighborhoods for real estate investment include Midtown, Buckhead, Virginia Highland, and Inman Park. Each of these neighborhoods has its own unique features and amenities, which can attract different types of tenants and buyers.

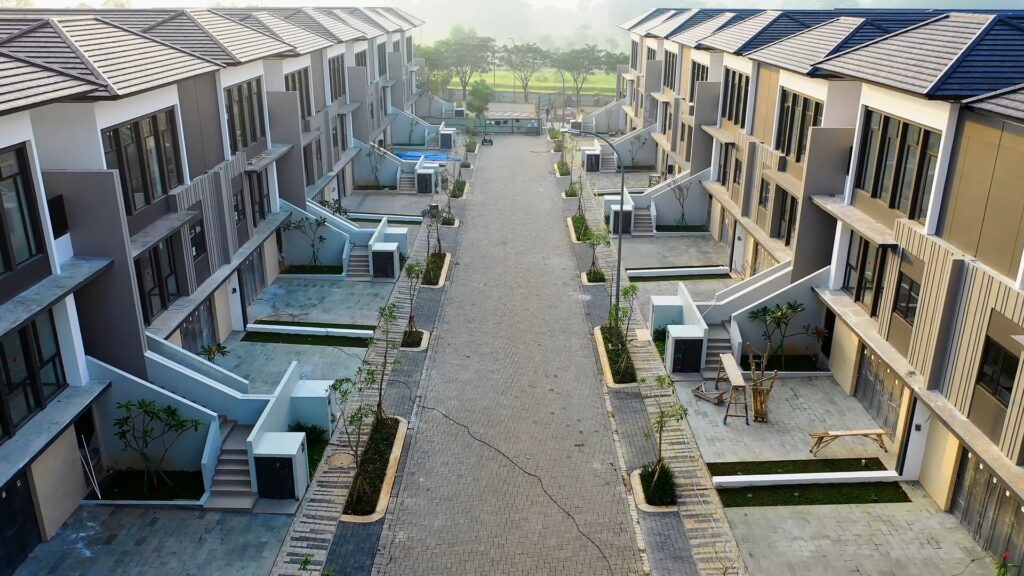

Property Types: Atlanta has a range of property types available for investment, including single-family homes, townhouses, condominiums, and commercial properties such as office buildings, retail centers, and industrial parks. Depending on your goals and expertise, you may choose to specialize in one or more of these property types.

Financing Options: There are many financing options available for real estate investors in Atlanta, including traditional bank loans, private lenders, and crowdfunding platforms. It’s important to do your research and compare rates and terms to find the best financing option for your needs.

Regulations and Taxes: Like any real estate market, Atlanta has its own set of regulations and taxes that investors need to be aware of. For example, Georgia has a state income tax rate of 5.75%, and Atlanta has a 1% sales tax on most goods and services. Additionally, landlords in Atlanta must comply with local regulations regarding tenant rights and property maintenance.

Rental Rates: Rental rates in Atlanta have been steadily increasing over the last few years, with the average rent for a one-bedroom apartment in the city currently around $1,200 per month. This can provide a steady source of income for investors who choose to purchase rental properties in high-demand areas.

Property Appreciation: The Atlanta real estate market has been appreciating steadily over the last few years, with home values in the city increasing by over 9% in 2020 alone. This means that investors who purchase properties in the right neighborhoods can benefit from long-term property appreciation, as well as potential short-term gains through resale.

Strong Economy: Atlanta is home to many major corporations and has a diverse economy, with a strong presence in industries such as finance, technology, and logistics. This can create opportunities for commercial real estate investment, as well as providing a stable economic foundation for the city’s real estate market.

Proximity to Major Transportation Hubs: Atlanta is home to one of the busiest airports in the world and is a major transportation hub for the southeastern United States. This can make it an attractive location for commercial real estate investment, as well as providing easy access to transportation for residents and businesses.

Overall, real estate investing in Atlanta, GA can be a profitable and rewarding venture for those who are willing to do their research, stay up-to-date on market trends, and make strategic investments. By choosing the right neighborhoods, property types, and financing options, and staying compliant with local regulations and taxes, investors can build a strong and successful real estate portfolio in Atlanta. With a growing population, strong economy, and diverse range of properties and industries, Atlanta is a prime location for real estate investment in the United States.